If you’ve been hunting for the perfect life insurance policy, you’ve probably come across the terms “cash value” and “face value” more than once. While they sound similar, they have very different definitions. Choosing a life insurance policy is a decision that will affect you and your family for decades to come, so you want to make sure you understand what you’re paying for. What is the difference between face value and cash value? Find out now.

What is Face Value?

Face value is the amount of money that the life insurance company promises to pay out to your beneficiaries upon your death. When you purchase a life insurance policy, you select a specific face value based on your financial obligations.

The face value of a life insurance policy remains constant throughout the policy’s term, it does not fluctuate with the market or the policyholder’s age or health. For example, if you have a life insurance policy with a face value of $500,000, your beneficiaries will receive $500,000 from the insurance company upon your death, as long as the policy is active.

Is Death Benefit Different Than Face Value?

Death Benefit is the term insurance companies use to describe the payout your beneficiaries will receive upon your death. Death Benefit is usually equal to the Face Value of the policy minus any withdrawals, accelerated benefits or outstanding loans.

For example, if you had a policy with $500,000 Face Value but you had years earlier borrowed $150,000 of Cash Value and hadn’t repaid it, your beneficiaries will receive a Death Benefit of $350,000.

What is Cash Value?

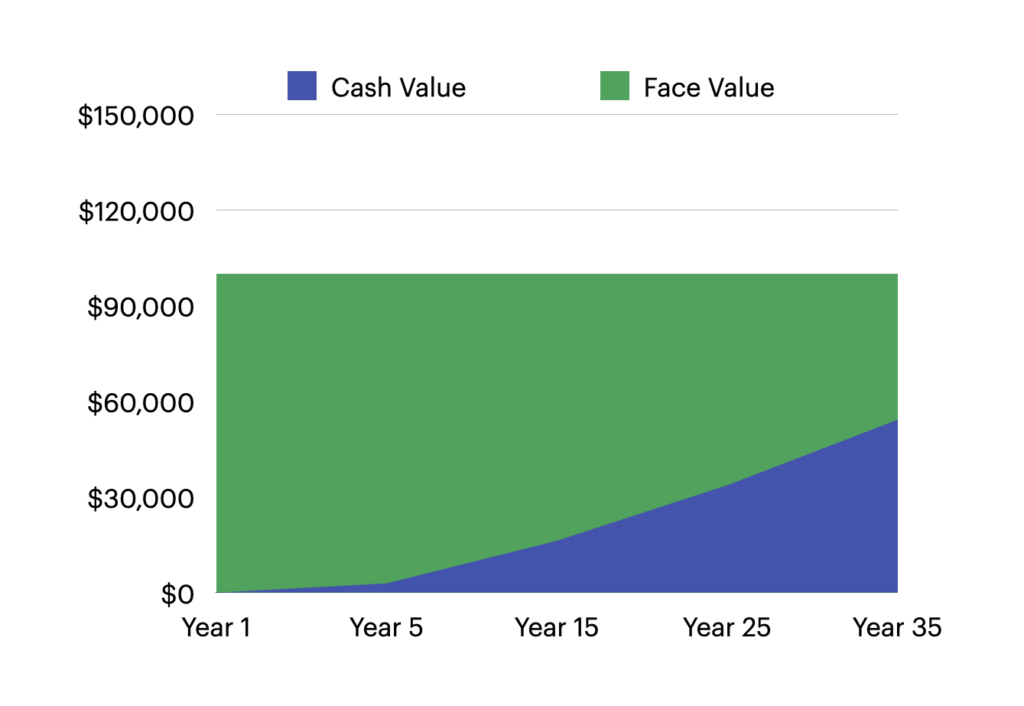

Cash value refers to the savings component of a whole or universal life insurance policy. It’s the portion of the policy that grows in value over time, similar to a savings or investment account. Over time, this cash value accumulates on a tax-deferred basis, meaning you won’t pay taxes on the growth of the cash value until you withdraw it, and depending on the particulars, even then it may not be subject to taxation.

The cash value can be accessed by the policyholder while they’re still alive. Generally speaking, if your policy terminates – either due to your canceling it (what the industry calls “surrendering” your policy) or simply due to nonpayment of premium (lapsing), you can expect to receive a payment representing the current cash value.

Subject to the specific provisions of the policy in question, policyholders can usually borrow against or in some cases withdraw the cash value of their policy. However, it’s important to note that tapping into the cash value could result in a reduction of the policy’s death benefit.

Face Value vs Cash Value in Life Insurance

While both face value and cash value are integral parts of a life insurance policy, they serve different purposes.

The face value fulfills the main purpose of life insurance, by providing a lump sum payment to beneficiaries upon the policyholder’s death. The cash value component allows policyholders to build a savings account within their life insurance policy, providing a potential source of funds that can be accessed during their lifetime.

All life insurance policies have a face value. But only whole or permanent life insurance policies build cash value. Term life insurance policies do not build cash value.

How Do You Take Cash Out of Your Life Insurance Policy?

So how do you access the cash value that your policy has accumulated? You have a few options:

- Withdrawal against the death benefit. You can usually take out a sum up to the amount you’ve paid in monthly premiums, but it will be deducted from the death benefit (the payout your beneficiaries will receive).

- Use it as a loan. If you don’t want it to be permanently deducted from the death benefit, most whole life policies allow you to borrow the Cash Value and pay it back with interest.

- Surrender the policy. This will allow you to take out all of the cash value (minus any surrendering fees), but this closes your policy and should absolutely be avoided when at all possible. Amounts paid in excess of premiums you paid will be taxable.

- Selling your life insurance policy. You could sell it to a third party, possibly for more even than the accumulated cash value. But the owner of the policy will be required to continue making monthly premium payments, and your beneficiaries would not receive the death benefit—instead, the buyer would. These are highly regulated transactions managed by specially licensed insurance professionals called “life settlement brokers.”

While there are clearly several different routes you can take to pull cash out of your life insurance policy, selling or surrendering the policy are certainly a last resort. Why? Because it defeats your initial purpose for opening the policy. When you sell or surrender, your beneficiaries will no longer receive a payout. Additionally, you may owe taxes if the cash value exceeds the sum of all of the premiums you paid.

Whole life insurance can accumulate significant cash value over time and that can be exciting. But we want to make sure your life insurance policy is fulfilling its primary goal: protecting your loved ones. Surrendering or selling the policy throws a wrench in that.

Should You Get a Whole Life Insurance Policy?

You’re probably thinking, why would anyone get a life insurance policy without cash value? The answer is simple: cost. A whole life policy is going to be significantly more expensive than a term life policy. The extra cash is a fantastic aspect, especially for those with a good deal of income and an already diverse financial portfolio. But if you’re working with limited means, there might be a better way to invest your money. We go into depth on who should get a whole life policy in this article.

Try Our Online Life Insurance Calculator

The most important factor when it comes to choosing a life insurance policy is that it’s going to provide the right amount of protection for your beneficiaries. How do you determine what that number is? Try our online life insurance calculator. Everyday Life Insurance works to show how simple life insurance can be. We’ve developed our systems to take the math out of it for our clients and leave that to the experts.