What Affects the Cost of Mortgage Protection and What Real Homeowners Pay

When you buy a home, you’re not just taking on a mortgage—you’re also taking on the responsibility of keeping that mortgage covered in the event of the unexpected. That’s where Mortgage Protection Insurance (MPI) comes in.

MPI is a type of life insurance designed to pay off your mortgage balance if you pass away during the policy term. It can give homeowners and their families peace of mind knowing their home will remain secure, even in difficult circumstances.

But how much does it actually cost? The answer depends on factors like your age, health, loan amount, and the length of the loan. To give you a clearer picture, we ran a few real-life examples using Everyday Life’s Mortgage Protection calculator.

Scenario 1: California – $1.5 Million Home

- Homeowner: Sophia Ramirez, 38

- Location: Rancho Palos Verdes, CA

- Loan Amount: $1.2M (20% down)

- Loan Term: 30 years at ~6.5%

MPI Cost: A standard term policy would be about $78.24 per month, coming out to $28,166.40 over the life of the loan.

What this means: For less than $80 a month, Sophia can lock in coverage that would completely pay off her jumbo mortgage if she passed away during the 30-year loan term. That’s a small price for security on a $1.5M home.

Scenario 2: Florida – $300K Home

- Homeowner: Tyler Johnson, 29

- Location: Apopka, FL

- Loan Amount: $270K (10% down)

- Loan Term: 30 years at ~6.25%

MPI Cost: Term riders to match the loan amount would range from $15.13 to $17.76 per month, with a total cost of about $6,078 over the life of the policy.

What this means: MPI for Tyler costs about the same as a couple of streaming subscriptions—and it guarantees his starter home will be fully paid off for his loved ones, no matter what happens.

Scenario 3: Massachusetts – $750K Home

- Homeowners: Emily Chen & Daniel Brooks, 42

- Location: Cambridge, MA

- Loan Amount: $600K (20% down)

- Loan Term: 30 years at ~6.375%

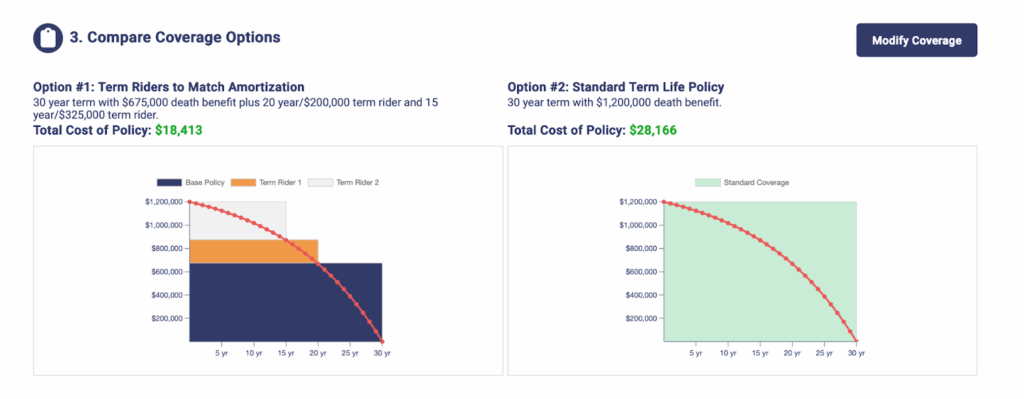

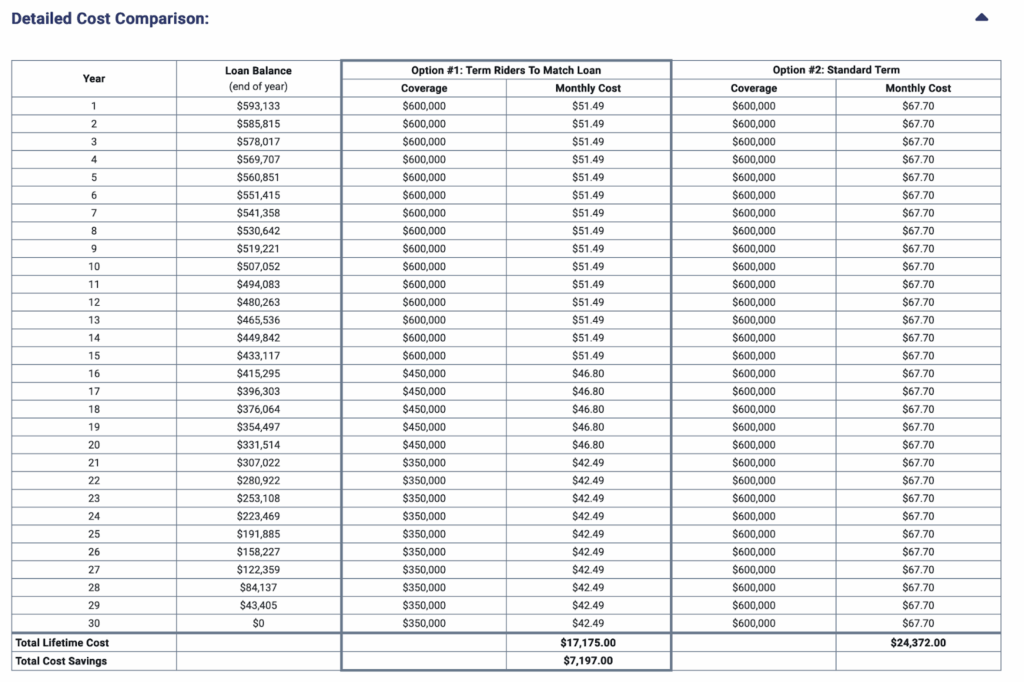

MPI Cost: Term riders to match the loan amount would range from $51.49 to $42.49 per month over the length of the policy, totaling $17,175.

What this means: For about $50 a month, Emily and Daniel have the peace of mind that their mortgage will be taken care of.

What Factors Impact Mortgage Protection Pricing?

MPI rates vary by borrower and property, but most policies are influenced by the same key factors. Your age and health are major considerations—healthier and younger applicants usually secure lower rates. The loan amount and loan term also play a big role: insuring a $1.2M mortgage over 30 years will cost significantly more than insuring a $270K loan for the same period. Finally, the type of coverage you select matters. Adding features like disability or unemployment riders will increase the monthly premium, but also expand the protection your policy offers.

Try Our Mortgage Protection Insurance Calculator

The cost of mortgage protection insurance differs for everyone, but it’s generally quite low compared to the cost of the overall mortgage.

If you’re concerned about what would happen to your home if something happened to you, mortgage protection insurance is worth exploring. Try out our online mortgage protection tool to see what your custom policy would look like.

You submit some basic information about yourself and your mortgage and our calculator offers customized coverage in seconds. You then have the option to further customize your recommended plan or to instantly move forward with the application.If you’re shopping for Mortgage Protection Insurance, skip the extra steps. Try our Mortgage Protection calculator now to see what offers await you.