We often think of life insurance as something for those who already have a mortgage, family, and probably some years under their belt. However, life insurance is not just a tool for protecting loved ones after you’re gone; it can also be a smart financial strategy for young adults depending on their circumstances.

Let’s dive in and explore why young adults should seriously consider life insurance and what type suits them best.

Financial Responsibility

As we grow up and become more independent, so do our financial responsibilities. Student loans, credit card debt, car payments, and even starting a family—all these factors come into play. If you have any loans at the moment, there will most likely be a clause in the contract concerning what would happen if the primary borrower passes. In some cases, that debt may fall onto the shoulders of the cosigner. Life insurance acts as a financial safety net, providing a lump sum payout to your beneficiaries that can help cover any outstanding debts or financial burdens you may leave behind.

Protecting Loved Ones

Life can be unpredictable, and tragic events do occur. While we don’t like to think about it, the truth is that accidents, illnesses, or unexpected circumstances can happen at any age. Having life insurance ensures that your loved ones are protected financially if the worst were to happen, easing their burden during an already challenging time. Even as young adults, many people are depended upon financially by their family members. But often in those situations individuals assume they can’t afford life insurance. That’s why we offer plans starting as low as $4 per month. Whether you have children, elderly parents, siblings, or other loved ones that would be financially impacted by your loss, life insurance can serve as a protection.

Lower Premiums

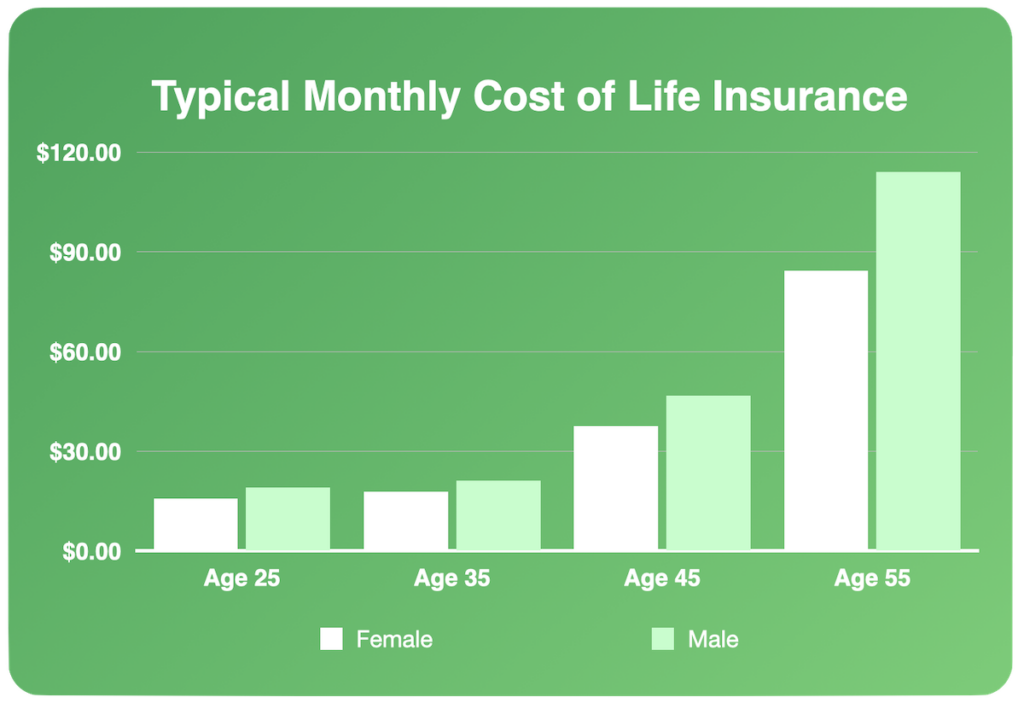

Timing is everything, and life insurance is no exception. One of the most significant advantages of purchasing life insurance in your 20’s is that it generally comes at a lower cost. Since younger individuals are considered healthier and have a longer life expectancy, insurance providers often offer more affordable premiums. By starting early, you lock in a low rate, potentially saving you thousands of dollars over the course of your policy.

The graph below illustrates the steepening monthly cost of life insurance over a typical person’s life:

How to Find The Best Life Insurance for Young Adults

Now that we understand why life insurance is important for some young adults, let’s explore the types of policies that suit their needs best:

Term Life Insurance

Term life insurance is a popular choice for young adults due to its simplicity and affordability. It provides coverage for a specific period, such as 10, 20, or 30 years. This type of policy offers a death benefit to your beneficiaries if you pass away during the term. Term life insurance is ideal for those seeking coverage to potentially replace their income during critical years, such as when starting a family, preparing kids for college or paying off debts. Plus, it’s budget-friendly and allows you to secure substantial coverage at a reasonable cost.

Whole Life Insurance:

Whole life insurance, as the name suggests, covers you for your entire life. Unlike term insurance, it has an investment component that builds cash value over time. Whole life policies are certainly more expensive upfront, but they offer lifelong coverage and can act as a financial asset. This type of policy serves as a long-term investment and estate planning tool. Whole life insurance is generally a better fit for a young person who earns enough to be less concerned about low monthly payments, and more concerned about diversifying their financial future.

Affordable Life Insurance for Young Adults

Life insurance is not just fit for the old and wise; it’s fit for the generous & responsible young people that offer support to their families. By securing life insurance early on, you can protect your family from potential financial hardships and even save some money along the way.

Remember, life is full of uncertainties, but with the right life insurance policy in place, you’re taking control of your future. Use our online calculator to explore the best life insurance plans for you today.